Table of Content

The original creator is too busy to review the Excel file and make sure the entire spreadsheet is working correctly, Need all tabs to add correctly, for the entire file. Need to make sure any future updates are automatically updated in the entire Excel file. Need the Excel file to be printable in 8 1/2" by 11" Letters Head.

The state insurance departments may set special dates for insurance companies to confirm that your claim has been filed. Let them know that documentation has already been made available to the company in great detail and include all of your contact and policy information. Hiring an insurance appraiser might help resolve a dispute. However, an insurance appraiser will not fight for you and can only assist you with the amount of a loss, not coverage issues. If you could not meet the insurance adjuster or forgot to mention certain things, send them proof or request another inspection.

RECENT POSTS

Ask your insurance company to provide you with reasons for the low estimate and a breakdown of their calculations. Be there when the insurance adjuster arrives to inspect the damage and point out things he may miss. You may be entitled, subject to the terms of your policy, to receive the cost to restore your home to its pre-loss condition. But many factors can influence the outcome of your claim.

Hes examining the deductible the total claimed damages the policy limits other policies that might also. The public adjuster had to have an independent reviewer which I had to pay out of pocket 750 come out to survey the damage and report back to Safeco. The insurance company estimates the cost of car damage by looking at several factors, including the make and model of your vehicle. The age and condition of your car are also considered when estimating how much it will cost to repair or replace it after an accident, as well as what kind of repairs you need (e.g., dent removal). Negotiating your low insurance repair estimate with your insurance company before you head to court can be beneficial for both parties. Many times, car companies are willing to do this and come up with a good settlement agreement that avoids going through the costs of litigation.

Other jobs related to home insurance adjuster estimate too low

When you buy a home insurance policy from your insurance company, you’re entering into a mutual contract. That contract states that your insurance company must cover certain types of damages. If an insurance company is refusing to cover certain damages that should be covered, intentionally stalling, or failing to thoroughly investigate your claim, then the company may be acting in bad faith.

Using a third-party mediator who is neutral and objective is sometimes the best option in that the procedures they use are often more informal and tend to be less confrontational than that of a court appearance. It’s also pretty quick and less costly, but settlement may not be as much as you would be able to obtain through a trial. Licensed public adjuster who can look after your best interests. Insurance adjusters, especially independent adjusters, can be hard to reach.

What if I take the low offer a home insurance adjuster gives?

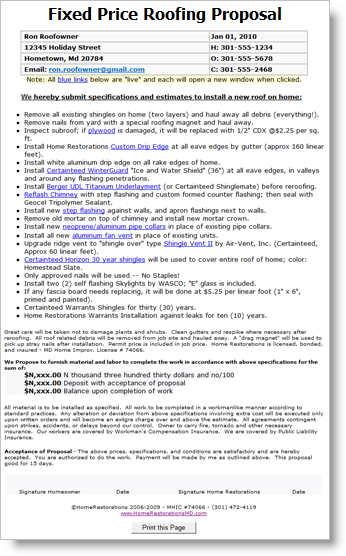

Review all of your documents, and make sure to provide proof of your damage. Then you can start to negotiate with your home insurance adjuster. The contractor gave Perry an estimate of 9850 to replace his roof so he filed a claim with his insurer. Too many insurance companies out there to pay for crap experiences like this go someplace else. After your home is damaged by an incident like a fire or a windstorm an insurance adjuster will be responsible for evaluating the damage. Ad New Customers Who Save Bundling Their Home Auto Save 25 on Average.

These adjusters respond to claims, assess damages, and assist with handling payouts to policyholders. Marc A. Wites is the founding shareholder of Wites Law Firm. He directs the firm’s litigation practice groups for personal injury and wrongful death cases, class actions, property insurance claims, sexual assault, and investment fraud. If your claim is denied, or if there is a meaningful difference between the amount your insurance company offers and the amount you need to repair and replace your damaged property, you should consider hiring a lawyer. Do you know which type of insurance adjuster assessed your claim?

Our reputation precedes us, and we fight tooth and nail to get our clients what they deserve, in a timely manner. Proving up replacement costs is not as easy as simply rebuilding your home and turning in the receipts. You have a right, though, to be paid the price to replace your home to its pre-loss condition, subject to the fine print in your policy. Entitled to under their insurance policy – now let us help you.

It’s significantly higher than you might expect to be charged by a public adjuster. So before hiring an attorney, first discuss your case with a reputable public adjuster. If you receive a home insurance adjuster estimate that’s too low, the following tips and advice can help secure a higher estimate. To find a public adjuster to represent your best interests click here.

The insurance company won’t immediately approve the rebuilding of your home. Instead, the adjuster needs to document the damage, verify costs, and compensate you based on the specific damages and losses. Your company employs salaried workers or independent contract workers called adjusters.

If the estimate is higher, you should contact your insurance claims manager and ask them to re-evaluate your case. They investigate complaints against insurance companies and can audit claim files to determine compliance with legal requirements. When you file a formal complaint, they will approach your insurer to get their side of the story.

We protect homeowners from the games and fine print insurance companies are known for. Find out why Pechaceks General Contracting Roofing Siding LLC is a top choice among Western Wisconsin and Eastern Minnesota homeowners and why 70 of our business comes from referrals and repeat customers. Most companies have a discount of either 5 or 10 other discounts are as low as 2 or as high as 15. Get Your Free Quote Now Proformance Roofing currently only serves the state of Florida. We Serve the Adjuster We love IA Firms and insurance companies but ultimately we serve the individual adjuster who in turn helps the IA firms and insurance companies succeed.

A larger volume of damage claims may force insurance adjusters to make rough estimates. If this occurs, you as the homeowner should be notified and expect a second visit from an insurance adjuster later. Know your homeowners policy.You need to review your policy to ensure that the low offer includes all of the damages your policy covers. An insurance company can act in bad faith if they fail to investigate your claim thoroughly or if they refuse to cover damages they are contractually obliged to meet. If you don’t feel comfortable negotiating on your own, it may be time to bring it your own public adjuster. Having a professional who “speaks insurance” and is also on your side can be a great help.

No comments:

Post a Comment